The development impact fees bill that passed the Baltimore County Council on May 23 was a compromise bill that included provisions from both the County Executive’s version and Councilman David Marks’s version, with some addition provisions and exemptions added. Some of those provisions were added at the request of other council members. However, some of the exemptions and changes seem to have been added at the last minute at the request of developers. With all the exemptions, there is some question about how much revenue the impact fees will actually generate. The fees also now won’t go into effect until July 1, 2020, which not only delays the revenue to the county, it means that some projects that would have been charged impact fees will now be exempt because a year from now they’ll be further along in the approval process.

Development impact fees are paid by the developer to help mitigate the impact of the development on infrastructure, including schools. See my post on the budget legislative session.

I’ve analyzed both the original bills and the amended bill that finally passed. A list of the provisions of each version of the bill are listed below.

Councilman Marks’s Original Bill

- Residential development only

- Effective for residential new construction with development plan approved after July 1, 2019

- For FY2020, residential fee is $3.00 per square foot

- For 2021 and later, County Administrative Officer submits proposal for any changes to the county council, after consultation with planning board and various departments.

- Fee calculated based on square feet in development plan at time of submission

- Fee is due within 30 days of recordation of the plat and before any building permits issued

- After issuance of the use and occupancy permit, the fee may be recalculated based on actual square footage, and if less than original calculation a refund is issued. If more than original calculation developer pays the difference.

- Deposited in a separate impact fee account

- May only be used for capital improvements (including debt service) within the district where the development occurred. (Based on BCPS facilities map)

- Conveyance of land or construction accepted by the county, including school construction, may be credited towards the impact fees

- Requires a written impact fee credit agreement with the county prior to conveyance or construction.

- Developments with affordable housing can receive a 35% credit on fees for each affordable unit

- Exemptions:

- Transient accommodations like hotels

- Developments which have already had a development conference

- New residential development that does not add any additional units

- Facilities built by the state, federal, or county governments

- Every two years the county administrative officer will provide a report & proposed changes to the county council

County Executive’s Bill

- Residential and non-residential development

- Exemptions

- Transient accommodations like hotels

- Farm construction for farm use

- Construction by county, state, or federal government, BCPS, or CCBC

- Religious purposes

- Affordable housing under a binding agreement to limit rent for 15 years

- Construction in enterprise zones

- Residential rates are fixed per unit ($5000 – $10,000 per unit)

- Nonresidential rates are per square foot ($1.50 per square foot for office/commercial, $.80 per square foot for industrial)

- Rates reviewed annually by the director of budget and finance and recommendations given to the county council

- Fee is to be paid when paying for a building permit

- Refundable if permit not approved

- Doesn’t limit county’s authority to enter into an agreement allowing dedication of land or providing infrastructure improvements in lieu of payment

- Fees will be 50% of regular fee schedule for fees paid within 180 days of enactment.

- The Director of Budget and Finance must recommend, and the County Council adopt, rates for senior housing and transit-oriented development before the impact surcharges are imposed.

Final Compromise Bill

Non-residential Construction

- Applies to new construction initiated after July 1, 2020. (There is a complex definition of when a project is initiated.)

- Goes into a separate development impact surcharge fund

- Fund is used only for public works and school construction projects countywide

- Directors of budget and finance and public works provide annual report to the county council

- Exemptions

- Farm construction for farm use

- Construction by county, state, or federal government, BCPS, or CCBC

- Religious purposes

- Development in an enterprise zone, commercial revitalization district, or Maryland opportunity zone

- Private schools, colleges or universities, or non-profit hospitals

- State designated transit-oriented developments

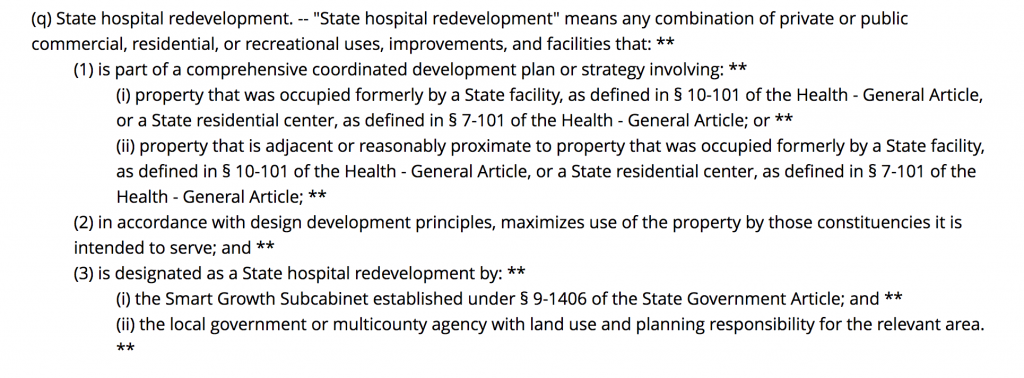

- State hospital redevelopment

- Country club redevelopment gets an extra six month extension. (January 1, 2021)

- Nonresidential fees are per square foot ($.80 – $1.50 per square foot)

- Rates reviewed every four years concurrent with CZMP process

- The Director of Permits, Approvals and Inspections may recommend a credit against the surcharge for capital improvements made by the developer (not including on-site sewer or transportation improvements)

- County may accept conveyance of land as a credit against the surcharge

- Surcharge to be paid any time between issuance of building permit and issuance of use and occupancy permit

Residential Construction

- Fee is based on percentage of gross sales price (1.5%)

- Rates reviewed every four years concurrent with CZMP process

- Payment due at time of settlement for a written title conveyance or lease, otherwise prior to issuance of a use and occupancy permit

- Revenue deposited in a separate development impact fees account

- May only be used for capital improvements (including debt service) within the district where the development occurred. (Based on BCPS facilities map)

- Conveyance of land or construction accepted by the county, including school construction, may be credited towards the impact fees

- Requires a written impact fee credit agreement with the county prior to conveyance or construction.

- Developments with affordable housing can receive a 35% credit on fees for each affordable unit

- Exemptions

- Transient accommodations like hotels

- Any residential development with non-appealable approval granted prior to effective date of act

- New residential development that does not add any additional units

- Facilities built by the state, federal, or county governments

- Dormitories

- Senior restricted communities

- Development in an enterprise zone, commercial revitalization district, or Maryland opportunity zone

- Private schools, colleges or universities, or non-profit hospitals

- State designated transit-oriented developments

- Religious purposes

- State hospital redevelopment

- Country club redevelopment with concept plan before January 1, 2021

- Planning Board, in consultation with various departments, will provide an annual report to the council

Exemptions

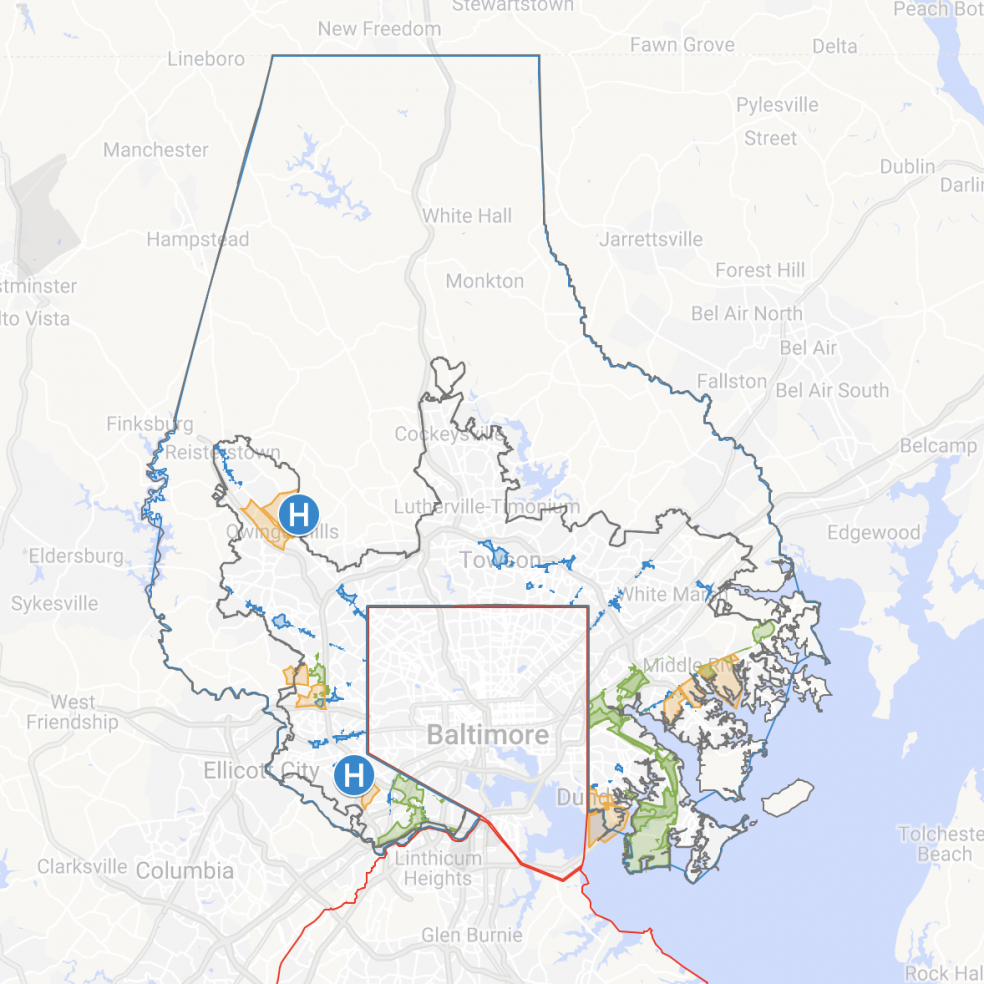

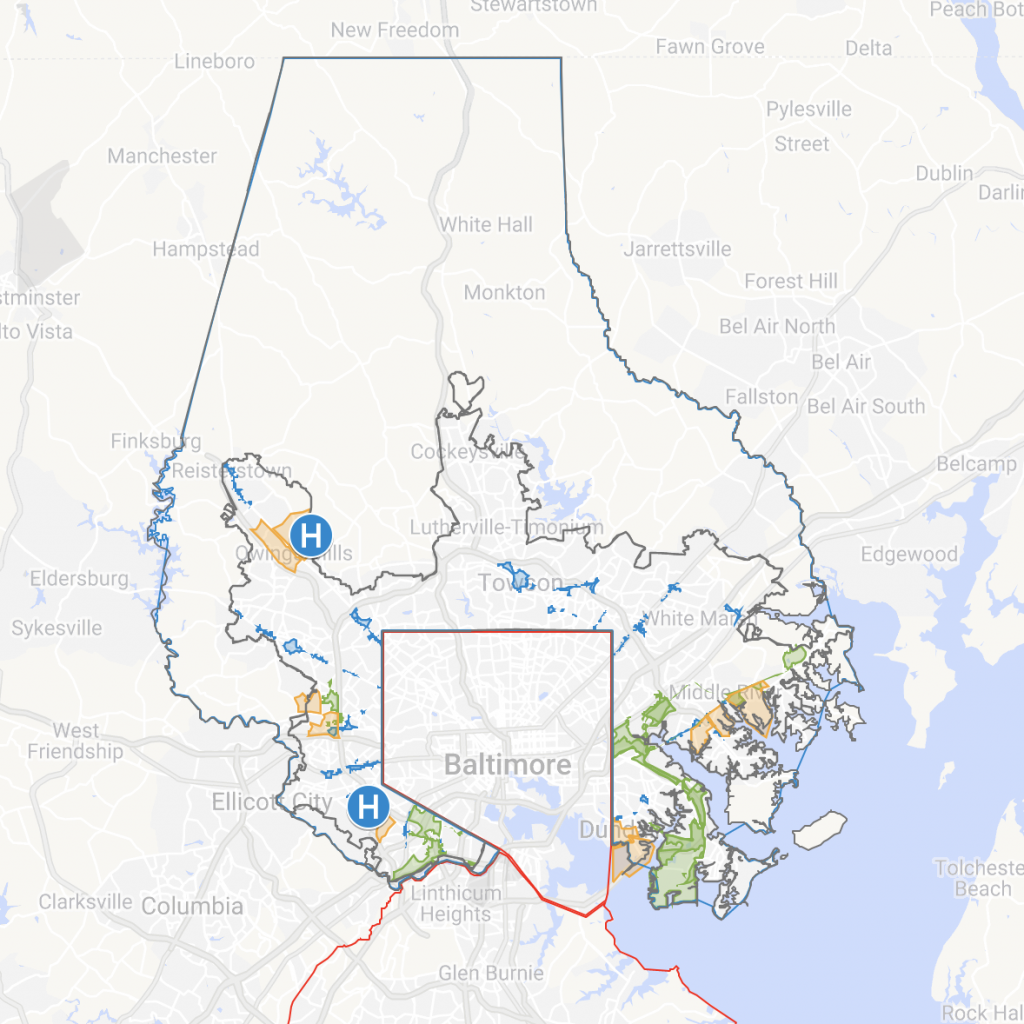

One of the biggest issues is the increased list of exemptions. Construction in Enterprise Zones was exempt under the County Executive’s version, but the final version also added Commercial Revitalization Districts and Maryland Opportunity Zones to that. To visualize how much area is impacted by those exemptions, I created a map of Baltimore County that shows all three zones, and the Urban-Rural Demarcation Line (URDL).

Even with all the exclusions, there’s still plenty of space left that’s not exempt. However, the exclusions will clearly have consequences:

- There is some logic to excluding these zones, since these are designed to encourage development in areas that need it, and the intent was not to then discourage development by adding additional fees. However, those zones are created to encourage investment in already distressed areas, and those areas are more likely to have urgent infrastructure needs.

- Southeast Baltimore County has a lot of excluded area and will be hurt the most by exclusions, especially for residential development, where the revenue collected can only be spent in the area of the county where it’s collected. Southwest Baltimore County, Owings Mills, and central Towson will also be hit by the exclusions.

- It’s hard to know how much of the non-exempt area inside the URDL is actually developable. (Development is limited in the large area outside the URDL.) Of course, this was always going to be a problem with impact fees in Baltimore County: so much developable land has already been developed that it limits how much revenue can be generated by new development. However, the exclusion zones exacerbate the problem.

- The exemptions for redevelopment of former state hospitals seems tailor made for Spring Grove and Rosewood State Hospital. However, both of these appear to be already exempt due to being located in Maryland Opportunity Zones.

- However, keep in mind that the definition of a State hospital redevelopment also includes property that is adjacent or reasonably proximate.

- The 6-month delay for redevelopment of country clubs smells of being designed with a particular project in mind, although council members claim it wasn’t.

- I agree with the credit for affordable housing. This is necessary to encourage developers to build affordable housing and keep it affordable.

Process and Transparency

More than this particular bill, my concern is more generally with the process and lack of transparency. Baltimore County has never had a high regard for citizen involvement or transparency, and although County Executive Johnny Olszewski has made transparency a priority in his administration, much of the County Council processes and procedures work to limit citizen involvement.

I don’t begrudge developers having a voice in the process; like everyone else, they have concerns and deserve to have their concerns heard. But their concerns should not have a higher priority than those of the citizens, and it becomes a problem when developers are able to incorporate last-minute changes that are then voted on with no opportunity for citizen engagement, or even for citizens to see what’s being voted on before the vote happens.

The county council’s standard procedure is to hold a public hearing (work session) on each bill to allow the public to testify. Work sessions are held at 2pm on a Tuesday in Towson, requiring many people to take off of work and drive to Towson on a weekday afternoon to participate in the process. Then the council generally votes on the bill one week later, at a legislative session held on a Monday evening. Sometimes amendments are voted on at a legislative session, and even after amendments are added, the bill itself is voted on immediately after any amendments are added, with no opportunity for citizens to see the amendments or provide input on the amended bill.

The final bill should never be voted on in the same session as amendments, except in the case of emergency bills. If a bill is amended, then that should trigger another round of public input with an opportunity for citizens to see the amended bill, contact their council member, and testify at a work session.

The county charter specifies that the county council must vote on bills within 65 days of introduction, and the county must publish bills in a newspaper at least once in the two consecutive weeks following introduction. (County Charter Article III Section 308) That should still provide enough time for a second round of transparency and public input. Sixty-five days is just over nine weeks. Even if you added a second round of publication, it’s still doable:

- Week 1: Introduction

- Week 2: Publication

- Week 3: Publication

- Week 4: Work session/public hearing

- Week 5: Legislative Session/vote on amendments OR vote on legislation if not amended

- Week 6: Publication

- Week 7: Publication

- Week 8: Work session/public hearing

- Week 9: Final vote (56 days after introduction)

Now, the impact fees bill was introduced as a part of the budget package, and it is true that the County Charter defines a specific (and very tight) timeline for the budget process. The County Executive must introduce the proposed budget no later than 75 days before the end of the fiscal year, ie., April 15. (Article VII Section 706.) The County Council must adopt the budget no later than one month before the end of the fiscal year, ie., May 31. (Article VII Section 709.) That’s only about 45 days, which includes time for publication, and the charter-specified timeline for the hearing, which is 7-20 days after the introduction of the proposed budget. That really doesn’t leave time for a second round of public input.

However, I think that although the impact fees bill was introduced as part of the budget package, since it’s not actually the budget, it wasn’t restricted to that timeline. But since the budget itself depended on the impact fees bill, if the bill and the budget hadn’t been amended, it would have had to pass at the same time as the budget. But, since the bill was amended such that it doesn’t take effect in FY20 anyway, and the Council made cuts to the budget to allow for that, it could have been tabled to allow for a more extended and thorough process. It’s particularly egregious that the vote was rushed in this case, because the entire original bill was essentially gutted and replaced with one long amendment that replaced the entire bill – meaning that the Council essentially was voting on a whole new bill.

Campaign Finance Reform

One final note: as long as developers are major contributors to many local campaigns, it’s impossible to know whether those contributions had an influence. Whether or not there was any actual influence, it creates an appearance of influence which causes citizens to mistrust their government.

Recently, the County Executive introduced, and the County Council passed, a measure that will put a question of public financing of elections on the ballot in 2020. Public financing like this helps to reduce the influence of business and big money contributions by allowing candidates who refuse those donations to receive matching funds for small donations, giving candidates funded by regular people a boost to help them against the big money donations. Small donor public financing also provides other benefits, such as greater citizen engagement. When you vote in 2020, please vote yes on the ballot question to allow the creation of a Baltimore County Citizens Election fund!

See also the excellent reporting by Alison Knezevich on the impact fees bill: New Baltimore County developer fees aim to cover cost of schools, roads. But the revenue is likely years away.

Final impact fees bill (original Marks bill is crossed out in the text here)